mkultrawide [any]

- 16 Posts

- 4.59K Comments

I don't have a ton of interaction with you (that I am aware of), and I missed the party on this one since I was touching grass or something like that, but right now it sounds like you are one of the only admins who for sure should be staying the in decision making loop. Mistakes happen when running any organization, it's unavoidable. I have seen the exact mistake you made (making changes to the site without consulting the wider userbase) so many times over the years. I've even done it once or twice myself. It's one of the most common mistakes made by admins/mods. You have done a good job of holding yourself accountable, which is #1 what a good admin/mod should be doing and #2 is more than I can say for a lot of your "colleagues". I don't think should be removing yourself from the decision making process.

- mkultrawide [any]toselfcrit•I'm stepping down as a moderator after recent events - selfcrit·2 months ago

Agreed. Maybe it's just because I'm probably older than a number of users here, but the number of times that things spiral here over minor bullshit is just absurd at this point. It feels like a bunch of angsty teenagers looking for someone to yell at.

- mkultrawide [any]toselfcrit•I'm stepping down as a moderator after recent events - selfcrit·2 months ago

Please do not step down. I have been offline for a few days and missed everything, but you aren't one of the people who should be stepping down, from the sound of it. The news mega is basically the only reason I use this site anymore.

Yes I know lol

You should lean into how useless Democrats are. I can't remember if it was Hasan or Ettingermentum last night on Hasan's stream, but one of them made the point that its not the left that's unpragmatic and ideological, its the Democratic leadership. Progressive policies are widely popular with the voters they need to win, including the socially conservative Latino's who just voted for Trump, but the Democrats would rather the party lose and remain right-wing than have to compromise with those progressive voters and give them policies they want. I feel like from there, most people here should be able to tie that back to the class interests of Democratic insiders.

If you are actually going to sincerely do this, remember its best to not call them stupid or gullible lol

Honestly, whoever ended up in charge was fucked either way, because I think we are on course for another big economic "correction".

- Show

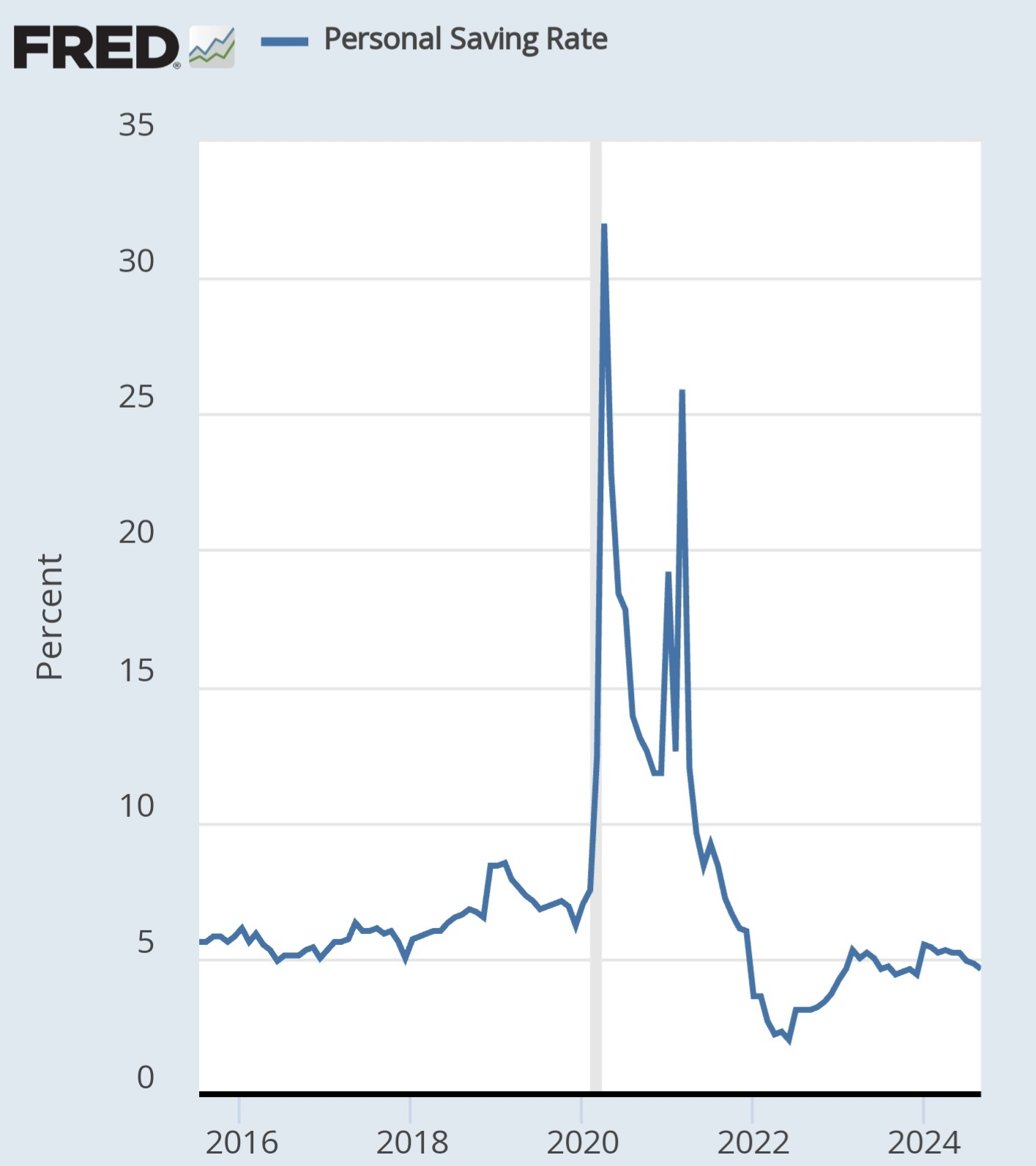

I'm going to just keep spamming this chart. I started telling liberals two years ago that this exact graph was going to be a huge problem for Biden, and they didn't want to believe it. They can chirp about how inflation is low now or unemployment all they want. People have an economic indicator they can check 24/7 from their pocket: their bank account balance. More people at the lower end of the income distribution were keeping more of their paycheck than probably at any other point of their lives at the end of the Trump admin, and now they have less of it than at almost any point of the Trump admin. There's a reason even the GOP struggles to cut Medicare and Social Security despite constantly talking about it: no one likes it when you take money out of their pockets, even the most deranged of chuds. Voters punished the Democrats for not doing enough to keep money in their pockets.

- mkultrawide [any]to

·2 months ago

·2 months ago"Please decouple yourselves from the country to which we intentionally helped chain you."

Folks, the Banderites aren't sending their best!

Incredibly frustrating to hear "educated" neoliberals talk about how "inflation is lower than anywhere else in the developed world" in response to people complaining about how high prices are. Those are fundamentally different things! Its day one, "EcOnOmIcS 101" stock versus flow variable stuff. The prices are too damn high! Saying prices are growing at a slower rate than elsewhere is a terrible retort to that complaint.

That CNN graph showing only 5 counties in the entire country where wage growth outpaced inflation needs to be spammed to all of these losers.

STOP BEING WOKE YOUR COLLEGE BULLSHIT LANGUAGE IS DRIVING AWAY THE GUSANOS

Now I beg you, organize. And when you think you're done organizing, organize some more. And when that is enough, no it isn't, more organization is needed. In times of extreme polarization, organization becomes desirable and mandatory.

Hasan called out a chatter on his stream who said "Now the left is really going to have to organize", and I think that single comment is probably the best argument in support of why Trump is actually better for the left to organize under than any Democrat (I voted for Cruz). All these progressives just spent he last 4 years at brunch and though they could cruise control their way to not having to do anything. A lot of people needed a wakeup call.

Can't wait to see liberals incorrectly apply "gusano" to latinos the same way they incorrectly use "tankie".

It should be illegal to announce any results before all the polls close, but yeah it sucks.

I can't find the comment (might not have been on this account) but a few years ago, I said if the Dems were serious about not wanting him back, they should have just made a deal with him to either pardon him or give him a deferred prosecution agreement in return for fucking off. Or broken off the head of state duties from the head of government duties, and just let him go around doing state dinners and playing golf with foreign dignitaries with no actual responsibilities. I've said before Trump's ideal office would basically be the President of Ireland.

It's kinda funny that what probably motivated Trump the most to run again was to avoid prosecution/getting sent to prison. If the Democrats had just treated his criminality the way they treated the criminality of GWB, I wonder if Trump just fucks off to Florida permanently.

Literally not offering anything of actual consequence to anyone who isn't rich and refusing to distance herself from Joe Biden.

Apparently the Dems may manage to hold onto the House.

Glad to hear it!