i saw one of those cringe crusader frog meme shirts in public recently, i don't know how you can wear that and not die of embarrassment

i saw one of those cringe crusader frog meme shirts in public recently, i don't know how you can wear that and not die of embarrassment

As the "second" biggest economy with a robust capital market, yes most likely. Along with diversifying into regional frontier markets, depending on the state actor's geopolitical goals.

What would be the endgame of this? Is this going to be allowed to be transferred across the Iraq/Turkey border into Syria or is this just posturing? Are Iranian missiles able to reach Israel from within their borders?

Bonds in Islamic countries are called Sukuk, instead of interest they transfer ownership of a real asset that provides income or is temporarily leased with rent payments to the holder of the Sukuk instead. The end result is the same as a bond and they function basically like an asset backed loan. Murabaha is basically just a fee charged for the service of having a purchase made in your name, rather than interest. This seems like Russia is trying to increase their ability to lend and borrow from majority Muslim countries, a precursor to further financial ties in the Middle East most likely.

US credit rating dropped from AAA to AA by 2 of 3 credit rating agencies, meaning US is no longer considered to have the highest credit rating.

https://archive.ph/jGsBA

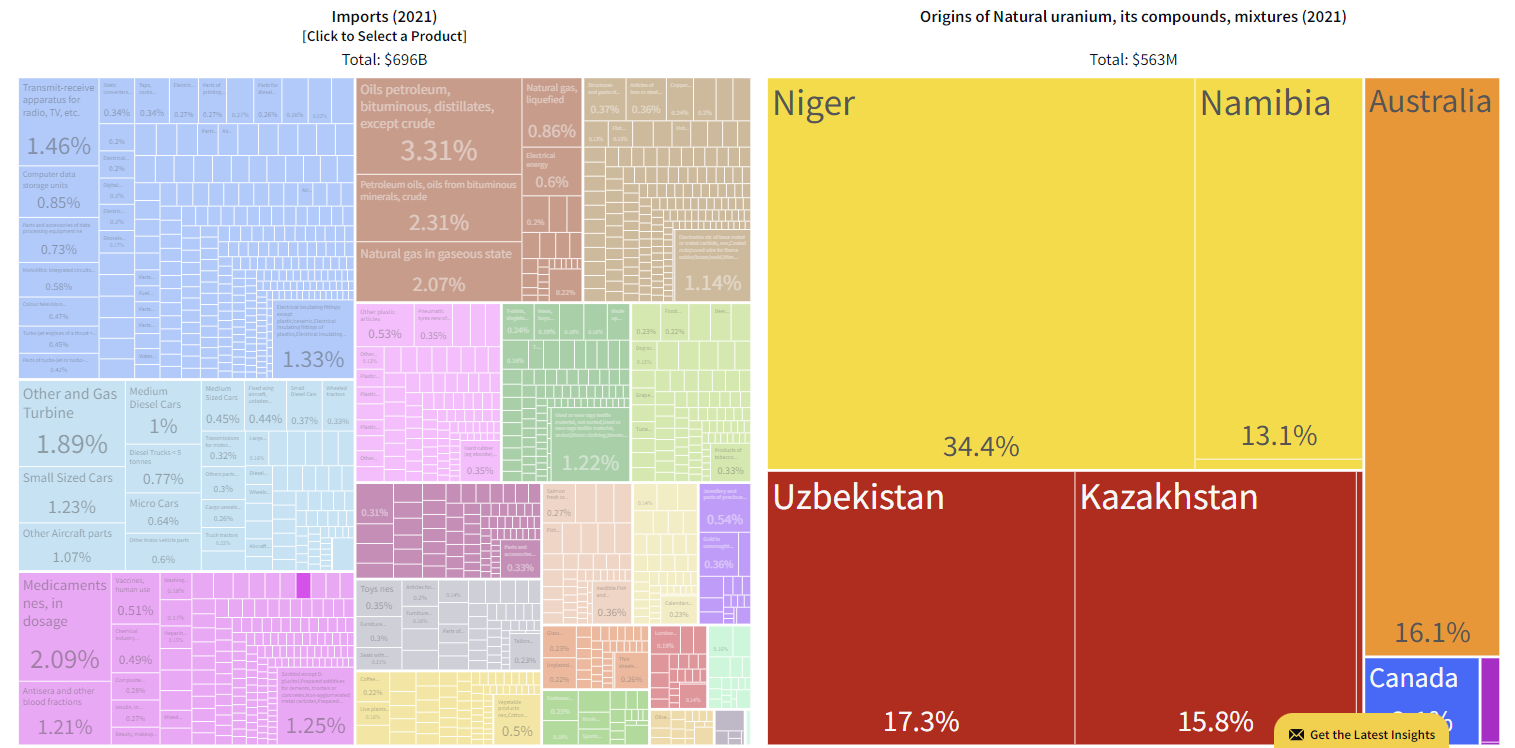

According to OEC, in 2021 (most recent free data) about 34% came from Niger. Though this is only natural u, its possible they also source LEU, in which case it seems to be about 20% (at hs4 depth); assuming they don't also export some of their own LEU.

Bonds in Islamic countries are called Sukuk, instead of interest they transfer ownership of a real asset that provides income or is temporarily leased with rent payments to the holder of the Sukuk instead. The end result is the same as a bond and they function basically like an asset backed loan.

Ironically one of the greenest fuels is synthetic methane using the Sabatier process. You take CO2 that's already in the atmosphere and water, add electricity and a catalyst, and you get oxygen and methane. The process does lose energy overall of course. No getting around the laws of physics. But methane is much easier and safer to transport and store than hydrogen for use in places where powerlines aren't practical or where you need a backup power supply. And it comes with the bonus of higher energy density.

Does this also apply to methanol or are there downsides to methanol synthesis? I know some shipping companies are experimenting with methanol as a green fuel. I've also heard ammonia being touted as another alternative green fuel, are you familiar with that at all? These seem like much more realistic alternatives to hydrogen, curious if you had any thoughts.

As far as I've seen, I think literally every product they sell is made of synthetics. So on that front, they probably would be worse than average for that reason alone.

The algorithm is a black box for a reason

KN94 has similar effectiveness to N95 masks, which is probably good enough in most cases. There are masks with better protection like P100 respirators, but these are probably overkill and inconvenient for most uses. The biggest factor that most people, even healthcare workers, overlook is the fit of the mask because it doesn't matter how much the mask protects you if you have gaps where ambient air can flow in. I've heard KN94 masks can be slightly finicky in this regard, so switching to N95 might help but it just depends on your face shape. Also, no facial hair as that effectively nullifies (cuts efficiency in half) the protective properties of masks if it intersects with where the mask meets your face (a mustache might be okay, but no full beard).

CBT/DBT/ACT are the big 3 therapy modalities that have the most research validating their results. DBT is good for certain mental health issues, especially personality disorders but is also useful for mood disorders. DBT groups are fairly common and can be the preferred method for administering treatment depending on your needs. If it was something recommended to you by a medical professional for a specific issue that seems relevant to what DBT addresses, or it seems like something that might help you with what you're struggling with, then by all means pursue it. Each practice/practitioner will vary, but as a treatment methodology it is scientifically sound.

Egypt has been getting reamed by inflation caused by imf loans already so I don't think this is a new development per se, but probably an ongoing escalation. Most likely Egypt is seeing the writing on the wall after the Saudis flipped and want to get away from the US, but having the Suez canal is obviously a massive liability for US naval power projection so it makes sense they'd be targeted in some form or another.

You gotta meet people where they're at and that requires understanding their definition and working around it to make your point clear, otherwise you're just talking past each other. I'm not saying you have to concede their definition explicitly, its probably best to ignore what doesn't make your point crystal clear, and by lumping the FDIC and securities swap together you're just making your whole argument easier to attack.

@mkultrawide is correct though. The point they're trying to make is that the FDIC thing isn't a bailout, which is probably why they led with it so that people will jump the gun and call it a bailout when it isn't since billions in bank equity and debt are getting wiped out. The securities swap is a bailout however (its basically backdoor quantitative easing), which came later, and is more technical and less talked about. It undercuts your position to not understand these technical nuances because it makes you look misinformed when you make statements that are factually wrong, even if they might be sound rhetorically. This is how technocrats argue and you're falling into their trap by not understanding these specifics.

The problem with the discount window is it signals to everyone that you're having financial problems which means it'll be even harder for you to get liquidity at competitive rates from the market once its known you're getting help from the fed. So it tends to be underutilized, however with financial stress already being so high it's probably the least bad option for some institutions which is why its seeing so much use currently.

Try the lowest dose and work your way up first to see if you can find a dosage with bearable side effects then determine if you're noticing any benefits. You could also try some medications to try and manage the side effects, alpha/beta blockers for the heart, and then maybe something for sleep. Don't be afraid to communicate your thoughts/wants with your practitioner, a lot of times it seems like they really do the bare minimum and its up to you to fill in the gaps, even going so far as to do your own research to figure out what might work for you.

Looks like you're in the green on this, so congrats. I'd still take this as a time to reflect on your reasoning since I'm not sure how much thought you put into this trade that you didn't disclose in your post.

In terms of risk reward, since your upside is only 3 points you should only have 1 point of downside. The reasoning for where your stop loss is makes sense but your entry doesn't from a risk reward perspective, meaning you shouldn't make the trade unless you got in at around 89 (3 down, 11 up). I don't know enough about the exchange itself or how withdrawals work, if you're assuming Monday morning they're going to get slammed in a bank run and it'll go to 0 immediately which my intuition wouldn't assume (if tether is still standing despite its obvious indiscretions). If I were in your shoes I would've gotten out at a 3% haircut and just take the tax write off rather than risk it all-or-nothing since this seems like a large enough sum that you're letting yourself get emotionally involved.

There are 2 main measures of inflation, core and non core. Core CPI excludes food and energy because it is "too volatile", it is the measure the Federal Reserve supposedly pays the most attention to regarding interest rate policy. However headline CPI is what tends to get the most press because it includes food and energy.