China and Brazil have reached a deal to trade in their own currencies, ditching the US dollar as an intermediary

The deal will enable China, the top rival to US economic hegemony, and Brazil, the biggest economy in Latin America, to conduct their massive trade and financial transactions directly, exchanging yuan for reais and vice versa instead of going through the dollar.

:xicko:

Now the Belt and Road Initiative, please

ok, hexbear, talk me down, why isn't this absolutely huge, cause I feel like it kinda is?

I’m a dumbass. I thought you were asking for an explanation for what it means lol.

spoiler

TLDR: one reason is that Brazil can save US dollars and pay off US debt/buy other stuff with USD with minimal sacrifice to goods and/or quality of life. Read/watch/listen to Michael Hudson for more thorough and accurate explanations, and/or Ben Norton for quicker updates on the dollar alternatives

The USD is the most used foreign exchange currency in international trade. Think of it as a ‘neutral’ anchor in which parties to a transaction lean on without complicating it by dealing with and verifying multiple currencies. Instead of me, you, and Bob running calculations on the peso, ruble, and franc to make a trade deal, we just use the USD and let its system handle it (oversimplified).

Think about neutral countries during high level meetings. Chinese and Russian leaders will meet each other in their respective countries because they trust each other. But American and Chinese leaders might meet in a third party country like Singapore in order to avoid complications.

The US makes a ton of money because people need to ‘buy’ USD in order to use in global trade AND debt payment. They do this usually by offloading their own currency or another country’s currency in exchange for the dollar, or through an American bond. An improper balance of USD and domestic currency will devastate your own economy. It can also be manipulated but that’s a bit more complicated.

So, here china and Brazil will use each other’s currencies for trade. That means that if Brazil and China earn USD through other means, they can use that to pay off debt owed to the Americans. They can also save those dollars to purchase other things that are only in USD. In other words, they’ll have more USD to spend on some things they need instead of having to worry about whether they have enough for every single transaction.

The US has a dominance over the world’s finances because of the dollar - unipolarity. Brazil and China are part of BRICS, which seek to de-dollarize and create “multipolarity,” a word you’ve probably seen a ton around here lately. They want to create an alternative currency for global trade to be used in addition to the USD. In other words, more diversity. Other countries in South America, Africa, the Middle East, have also expressed interest in BRICS, but they also want to form a regional currency like the Euro.

It will take a long time, but if the world does manage to achieve multipolarity, it means the US loses a significant leverage because people won’t prioritize buying USD for everything.

Just want to add that the Dollar being the go-to trading currency also enables the US to print money to finance itself while offloading the inflation that such a thing would usually cause to the global economy instead of just itself.

Reduced global demand for dollars squeezes the US's finances and may some day cause it to have to grapple with its huge deficit.

still appreciated comrade :stalin-approval:

now, do you have an opinion on whether I should be in sicko mode or not?

Great post.

It's also worth underlining that much of the reserve assets of dollars that are held internationally are actually in the form of US-dollar bonds, meaning that those holding them are essentially lending to the US.

It also inflates the value of the dollar, making imports cheaper and debt repayment more difficult (seen from this angle/aspect as well).

I have some noob questions.

You buy us bonds to get usd? What are these bonds? What does it mean for china or japan to own us debt? What happens when us prints more money to other currencies?

This is an excellent explanation. I think one thing that could be also mentioned is that with the USD, they could purchase oil, but that involves yet another huge effortpost about the petrodollar, with a complication that China has its own oil company and the consequences of that.

Thanks for that explanation. Really. I never knew the part about the reserve bank.

So, in reality, they probably get some RNB to invest in manufacture, and the rest they use to buy treasury bonds, on which the US pays them some interest (in usd)?

And the US gets to use that money they get to do whatever they want.

So what happens then? Does the US need to pay back the entire amount some time in the future like you have to with loans?

I don’t even understand how all this started or why it’s there.

If you know of any Marxist/leftist person who goes into this modern financial hellhole in details, please let me know.

I don’t even understand how all this started or why it’s there.

TLDR: The US was massacring too many Viets and Koreans and were racking up a lot of debt because of that. They stopped pegging the dollar to gold, and now everyone had useless funny money in the vault. On the surface, this is good for those countries because now the USD is useless, but that means their own currencies are much more valuable thus products and services will become expensive. In order to combat those expenses, they have to prop up the dollar by trading in and buying USD , thus lowering domestic currency values which equals less expenses.

I would check out Superimperialism by Michael Hudson. It explains the origins of this mess. I don't know if it's the "definitive" book on the subject, but it was even used by the US government to help them understand their own financial domination.

His other works are also good for understanding modern finance speak. He has interviews , lectures, and podcasts that covers these things although most of them assume you're sorta familiar with what's going on. The one I linked is from Grayzone - they are cringe nowadays, but Ben Norton was an ex-writer there and has moved to an independent outlet which is much better. In many episodes he also summarizes or fully explains concepts that might bore veteran listeners, but good for newbies (or he'll link further info in the description box). Hudson is also a regular contributor to his show.

but it was even used by the US government to help them understand their own financial domination.

This is so darkly humorous. They don’t even know what they did, huh.

Thanks for the rec and the explanation!

Wow. First, thanks for the explanation.

the government cannot print too much money, or else people will start exchanging them for dollars and your currency will lose its value.

And people do this because USD is safer. If your country is printing too much money, it means it needs to do something which it cannot currently afford and so it’s value is going to go down (wrt USD) so people buy USD as quickly as possible?

The more central banks store their earned dollars in US treasuries, the more US can spend to get its free lunch anywhere on earth.

O.O

So, wait, the US basically did alchemy and converted dollar into gold - the one thing guaranteeing currencies remain compatible - but the US is the only one capable of making more of this new gold, and making it basically out of thin air with no effort needed.

And… the rest of the world just went along with it? Why didn’t the USSR do something? This was the 70s, right? They weren’t that stagnating yet. And China was still non-Nixoned.

What happens today if the US decides to print $1 trillion to, idk, buy Greenland. That would still decrease the value of USD right? But that’s not a threat anymore? What if China or another country tries to do the same? Will they face greater repercussions?

I will def check out that book and Michael Hudson’s other works.

So what happens then? Does the US need to pay back the entire amount some time in the future like you have to with loans?

I'm not sure if it's the same with global trade, but typically, yes, that's how bonds are paid back. The government takes your money and invests it themselves, or they use it to fund projects at home. Whether they make profit or get the money elsewhere, they're expected to pay back the investor the principal + the interest (which is usually low, but high enough to beat bank interests and somewhat keep up with inflation). Bonds are popular in order to protect the value of your money since it's relatively safer than stocks since it's the government that's paying you back. Although companies also hand out bonds too if they need funding. The typical saying I hear in investing is that if bonds aren't safe and the government can't guarantee payment back to you, then you have a lot more to worry about than bonds.

Well, as with with anything w/r/t de-dollarization, there is a loooong row to hoe. The USD is just thoroughly dominant in international transactions and currency reserves. No doubt it's possible that de-dollarization will snowball and the rate of de-dollarization increases over time, we are still a long way from the US feeling the real negative consequences.

Good comments in here.

It's super important that comrades understand how essential the unique status of the U$-dollar is to the mechanisms of the U$A's imperialism.

At what point do psychopaths enter into shambles?

In my experience it's when they realise they caught

When their delusions crash headlong into reality in a way that they cannot possibly ignore because it causes them catastrophic material consequences.

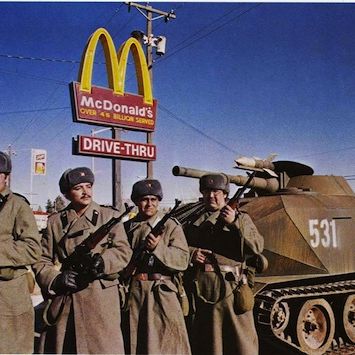

This just in, at the request of the government-in-exile headed by Jair Bolsonaro, the US is set to launch military operations in Brazil to topple the tyrant Lula and restore democracy to the people of Brazil. The Biden admin states that there have been credible reports that under the Lula regime the citizens are made to eat ground human and that Lula is working directly with the antichrist to open a portal to hell. Former US President George W. Bush has denounced President Lula as a "neo-Baathist."